Thank you for contacting OAREX. A liquidity specialist will call you shortly to learn more and prequalify you. If approved with an account, you can apply, link your revenue dashboards, and begin the funding process.

While you’re here, check out some of our content.

Here Are The 30 OAREX Top Payors From H2 2024

H1 2024 Top Payors

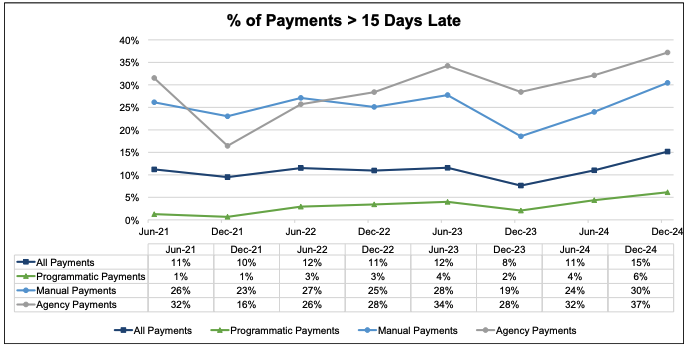

Poor Digital Media Payment Performance Continued in H2 2024

In our previous report for H1 2024, payment performance improved slightly but remained at elevated levels. During that time, we saw several metrics bounce off of all time highs or…

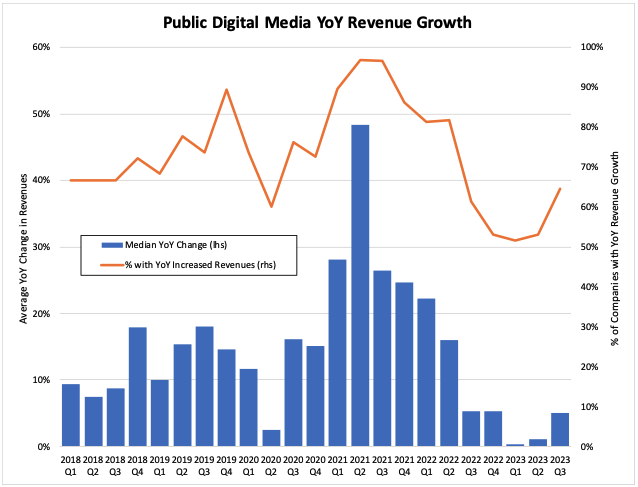

Q3 2024 Digital Media Revenue Growth Rebounded and Volatility Accelerated

During Q3 2024, digital media revenue growth rebounded, and volatility accelerated at a record pace. After 9 consecutive quarters of 6% or less growth, median revenue growth rose to 9%…

Q2 2024 Digital Media Revenue Growth Is Still Low, But Volatility Returns

For eight consecutive quarters, the digital media industry has experienced abnormally low growth. While that sluggish performance continued for Q2 2024 digital media revenues, it wasn’t all bad. For the…

Here Are The 24 OAREX Top Payors For H1 2024

H1 2024 Top Payors

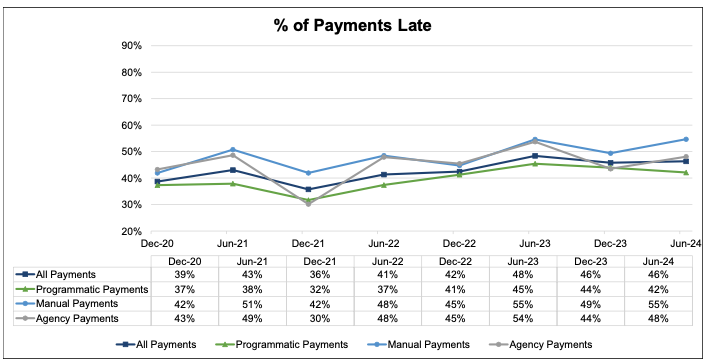

Overall Performance Improved In H1 2024, Despite Later Payments

The media and advertising landscape is ever-evolving and payment performance remains a critical indicator of industry health. In our previous report for H2 2023, debtor payment performance began showing mixed…

Q4 2023 Digital Media Revenue Growth, Positive But Flat.

Following a prolonged period of successively worsening performance, revenue growth began showing signs of a rebound in Q3. While still far below historical performance, year-over-year (YoY) median revenue growth increased…

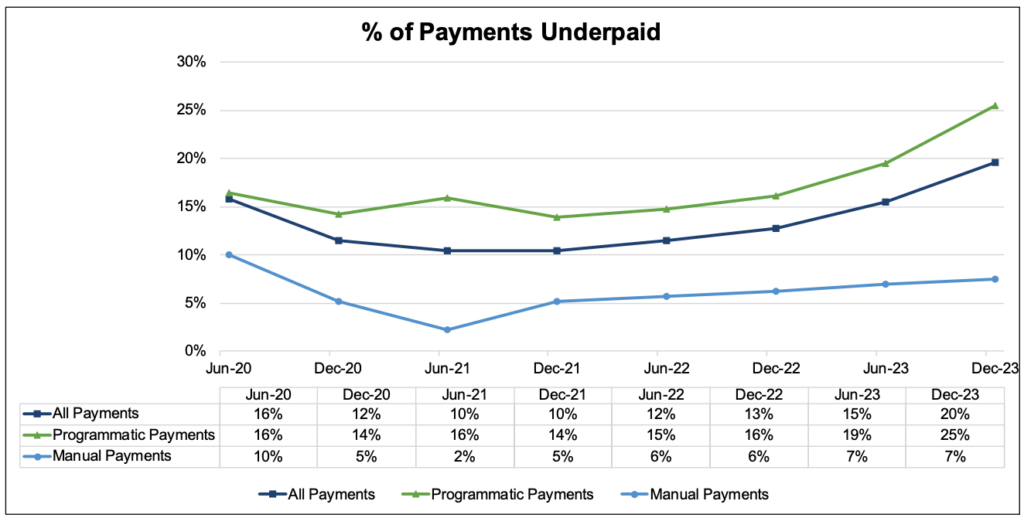

H2 2023 Top Payors Brought Certainty Amid Turbulence

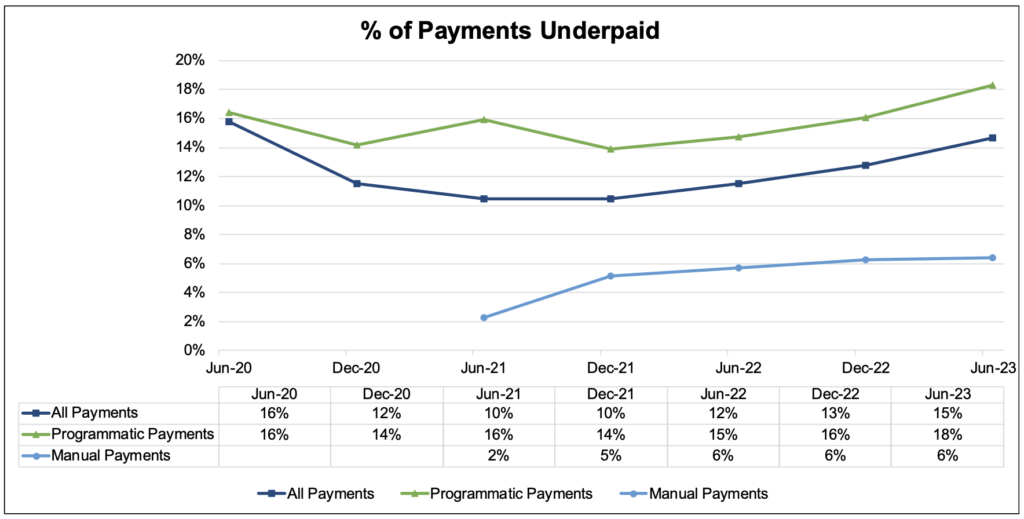

While underpayments surged to a new all-time high the H2 2023 Top Payors brought some much needed certainty to the industry. The OAREX H2 2023 Digital Media & Advertising Payments…

Media & Advertising: Late Payments Ease, Underpayments Surge To A New All-Time High

The media and advertising landscape is ever-evolving and payment performance remains a critical indicator of industry health. In our previous report for H1 2023, debtor pay performance continued it’s downward…

Did Q3 2023 Digital Media Revenue Growth Rebound? Not Quite.

Did Q3 2023 digital media revenue growth rebound? Not quite. Since beginning its downward trend in Q3 2022, digital media revenue growth has continued to worsen with each new quarter.…

H1 2023 Top Payors Prevailed Despite More Defaults in AdTech

It was a rocky finish to the first half of this year, but the H1 2023 Top Payors prevailed despite more defaults in AdTech. Unfortunately, that wasn’t the case for…

Worst 6 Months for Payments Since COVID

Today we are releasing our bi-annual payment study, which outlines why H1 2023 experienced the worst 6 months for payments since COVID. In our report, we cover payment trends in…