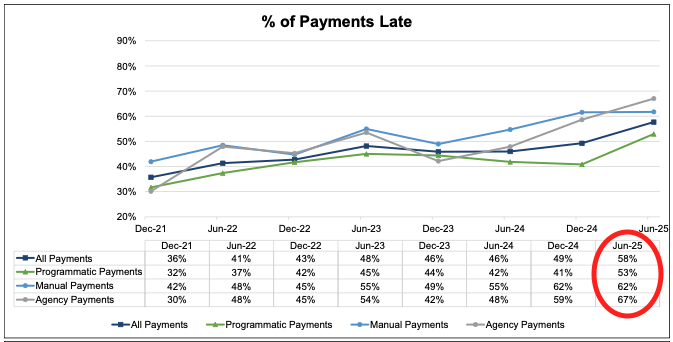

Digital Media Payments Were Late in H1 2025, revealing a sharp decline in payment reliability, with 58% of all payments arriving late — the highest rate since tracking began. According to OAREX’s latest Digital Media & Advertising Payments Study, this pattern of late payments underscores a broader shift in digital media payment behavior — as companies respond to liquidity strain, higher interest rates, and tightening credit markets.

Recent data confirms this shift. The American Bankers Association Credit Conditions Index fell below 50 for the second consecutive quarter (source), while Fitch Ratings warned of ongoing credit tightening driven by geopolitical and trade policy risks (source).

As capital becomes more expensive and liquidity remains tight, companies often turn to delaying payments as a cash management strategy. That shift may help explain why 58% of digital media payments were late in H1 2025 — the highest rate since OAREX began tracking.

The OAREX H1 2025 Pay Study reveals how these macroeconomic pressures are playing out across the digital advertising ecosystem.

Key Findings In The Report

- Late payments hit a record high – 58% of all payments were late in H1 2025, up from 49% in the prior period. Programmatic payments drove the surge, jumping from 41% to 53% late.

- Longer delays become the norm – 32% of payments were more than 5 days late and 18% of payments were more than 15 days late, both at record new highs.

- Underpayments reversed sharply – After peaking at 20% in 2023, underpayments fell to 10% in H1 2025 and returned to their lowest level since 2021.

- Reliable payors are becoming scarce – The share of “good-paying” debtors dropped from 53% to 43%, driven by a steep decline in always-on-time payors (down from 21% to 13%).

Our Takeaway

For participants across the digital media and advertising supply chain, these trends signal more than just payment friction—they reflect a shifting financial landscape. The re-acceleration in late payments and the shrinking pool of good-paying debtors suggest a growing divergence in credit health that businesses must monitor closely.

While operational efficiency may have improved, working capital stress continues to rise. For publishers, platforms, and agencies, understanding payor reliability is no longer optional—it’s a strategic imperative. As the market adapts to economic uncertainty, real-time insights into payment behavior will be critical for navigating risk and maintaining cash flow resilience.

That is where we can help—reach out today to learn about how OAREX helps you de-risk cash flow and maximize scale. Schedule a call to speak with our team.