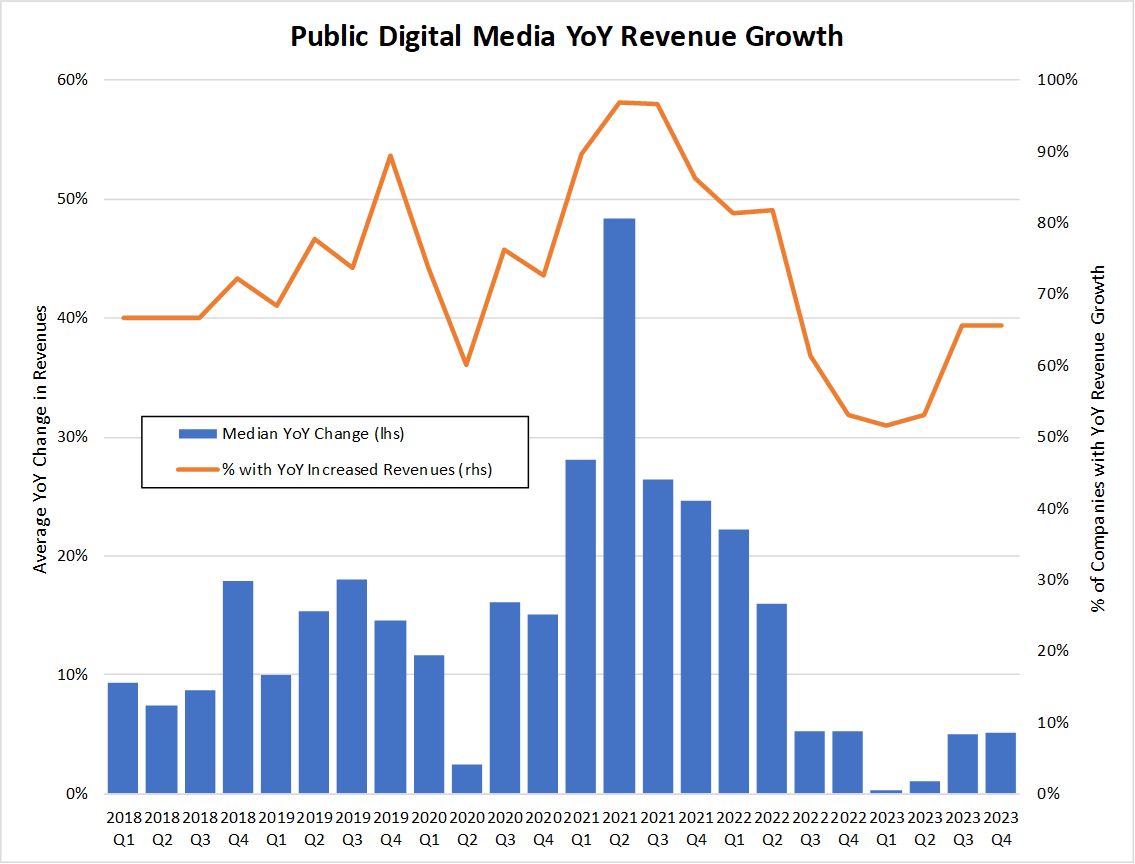

Following a prolonged period of successively worsening performance, revenue growth began showing signs of a rebound in Q3. While still far below historical performance, year-over-year (YoY) median revenue growth increased 5%. Coming off of two quarters with the worst performance on record, this was a sizable jump. Unfortunately, Q4 digital media revenue growth was positive but flat. Growth did not continue accelerating at the same pace but held constant at 5%. Although it was positive, Q4 marked the 6th consecutive quarter of historically low growth and the 7th consecutive quarter of consistently low volatility. In fact, there appears to be some consolidation happening because the number of companies with positive growth rose 13% YoY but the median growth rate held constant. Our hope is that a rebound is underway and we may be regaining a sense of stability, but it is still uncertain if we have turned a corner yet.

Tired of mainstream media focusing only on “Big AdTech”, our team began examining public revenue data for the broader digital media industry. We review the revenues of more than 30 public digital media companies and compare their performance next to “Big AdTech”. In our last report, with a median growth rate of 5%, digital media revenue began to show signs of life after five consecutive quarters of low growth. Today we are releasing the 2023 Q4 Digital Media Revenue Report to share our findings.

Companies Analyzed

We evaluated data from publicly traded companies, in the USA, with financial reports denominated in USD. Those companies must also earn a majority of their revenues from digital media operations and have been underwritten by OAREX’s credit team. Furthermore, we excluded some “Big AdTech” companies to ensure the data was not outweighed by industry giants (i.e. Google, Meta, and Snap).

Key Findings In The Report

- 66% of companies saw positive revenue growth during Q4 2023, up from 53% YoY, but median revenue growth held flat at 5%. Making this the 6th consecutive quarter with growth of 5% or less and the longest period of sustained low growth on record.

- Google Network (their Display business) was down 2% YoY, while Snap was up by 5% and Meta was up 25%.

- Data continues to suggest size and performance are correlated, with YoY growth of larger companies (excluding Google, Meta and Snap) out performing the smaller ones. In Q4, all but one of the companies with market capitalizations over $5 billion saw revenue growth of 20% or more.

- With Q4 dispersion at 18%, volatility of revenue performance remains historically low. This marks the 7th consecutive quarter, and the longest sustained period, of consistently low volatility.

- Best Performance: Unity, Applovin, DoubleVerify, Hubspot and The Trade Desk experienced YoY growth rates of 20% or more.

- Worst Performance: System1 and Tegna saw revenue growth decrease by over 20%.

Our Takeaway

As positive light continues to shine on the revenue growth front, uncertainty remains high. Will growth continue to remain constant? While revenues continued growing there is an ever changing narrative that will certainly have an effect on performance. It appears that the much anticipated rate cuts of 2024 are no longer a sure bet. Some economists are even predicting a push to 2025 for a change in rates. What exactly this means for advertisers and the economy at large is yet to be determined but a continued focus on capital and credit management remains paramount. Why is this so important? First, by ensuring access to capital companies can continue to capitalize on opportunities without cash flow constraints. Secondly, by staying vigilant with credit management, businesses can safeguard against potential risks of non payment. If navigating credit analysis and financial strategies isn’t your forte, OAREX is here to help.

Want to see more? Download a copy of our free report here or schedule a call to speak with our team.