The media and advertising landscape is ever-evolving and payment performance remains a critical indicator of industry health. In our previous report for H1 2023, debtor pay performance continued it’s downward trend and surpassed the awful performance seen during the COVID lockdowns. While H2 2023 showed a glimmer of improvement, other concerning trends continued gaining strength. That kernel of positive makes this feel like one of those, “do you want the good news first or the bad news” scenarios. Apparently science supports starting with the bad, so here goes nothing. Underpayments surged to a new all-time high and set a record for the biggest 6 month increase ever. However, while overall late payments remain elevated, they posted slight improvements and eased for the first time since H1 2022. That was the good news (if you can call it that), was it more palatable since we led with the bad?

None of this should come as a surprise since H1 2023 saw several notable bankruptcies like EMX and MediaMath. These, along with tightening economic conditions and other concerning credit events like SVB’s collapse, exasperated the existing liquidity strain and introduced a ripple effect via sequential liability. Given the trends we’ve seen unfolding in underpayments, we believe those factors have played a significant role. The industry is feeling the impact on a broad scale, whether it’s directly from offsets or indirectly as companies take cautious steps to minimize future risks and strengthen their financial positions. Read more or download our report to find out why H2 2023 was the worst 6 months for payments since COVID.

Key Findings In The Report

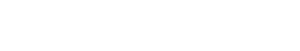

- Underpayments experienced an unprecedented spike to record highs – underpayments had a record increase of 5% in H2 and comprised a staggering 20% of total payments. This surge was driven by programmatic partners who increased by 6% compared to H1 2023, up to 25% of all programmatic payments.

- Late payments improved but remains elevated – late payments decreased from 48% to 46% of all payments during H2. A marginal improvement that marks the first decrease since H1 2022. Additionally, the average payment fell from 3 days late to 2 days late. While that may be a breath of fresh air, it is important to keep in mind that late payments remain elevated and are only 6% away from their COVID highs.

- Frequency of late/underpayments continued rising – payments made more than 15 days late dropped from 12% to 8% but the average payment delay held steady at 11 days. Additionally, the increase in underpayments was driven primarily from smaller offsets rather than larger outliers. These points suggest both late payments and underpayments are becoming more frequent.

- Manual demand (Direct & Agency) led the way – manual demand saw the biggest improvements in payment performance. 50% of all manual payments were late (a 5% decrease) and 19% were more than 15 days late (a 9% decrease). Additionally, manual payments were 6 days late on average ( down from 10 days late in H1).

- Only 3 partners never paid late – this marks another new low as late payments have seemingly become normalized among demand partners. Interestingly, both extremes (i.e. always late or never late) continue shrinking.

Our Takeaway

It’s evident that the media and advertising industry continues to grapple with a complex credit environment. The poor payment performance we’ve consecutively seen these several months shows no signs of abating anytime soon. All eyes will be on the Federal Reserve this week to see if they plan to cut rates. There are many speculative views on what the fed will do. A rate cut seems unlikely thanks to inflation unexpectedly rising in February and economic conditions beginning to signal stagflation.

Our hope is that the growing trend in underpayments is largely influenced by sequential liability stemming from H1 2023 bankruptcies and may subside later on. Hard to say though as the ripple effect is difficult to measure and the growing frequency of smaller offsets may suggest there is more to the picture. Furthermore, the modest improvement in late payments alone is not enough to suggest a meaningful change in payment performance will occur anytime soon. Late payments have historically been accepted as a standard among AdTech. Increasing frequency may suggest this to be the norm more than ever before. We refuse to accept this as a “cost of doing business” though and will continue to provide flexible liquidity solutions to help downstream partners avoid costly cash flow gaps. We remain steadfast that, as businesses navigate this landscape, it’s imperative to adopt proactive measures to mitigate risks and safeguard financial stability.

Want to learn more about how OAREX can help you de-risk your cash flow and scale? Schedule a call to speak with our team.