In our previous report for H1 2024, payment performance improved slightly but remained at elevated levels. During that time, we saw several metrics bounce off of all time highs or begin to show signs of a plateau. The percentage of late payments across our portfolio held flat at 46% but was still only 2% shy of their recent high. Underpayments fell sharply but remained near their high and extremely elevated compared to historical performance. The general consensus was positive but overall payment trends were mixed. The sentiment this time is less positive and trends are still mixed. Read more or download our report to find out why poor digital media payment performance continued in H2 2024.

Key Findings In The Report

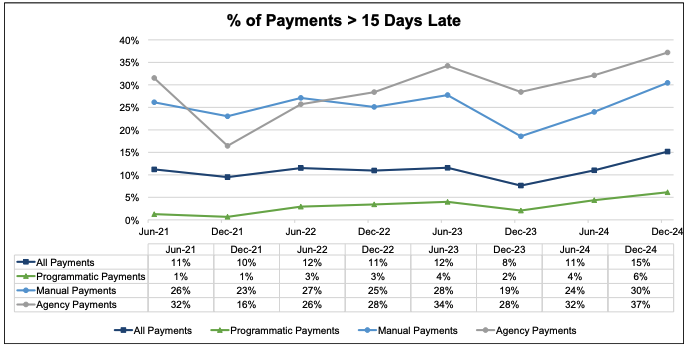

- Late payments remain elevated and arrived later – 48% of all payments were late in H2 2024, marking the 4th consecutive report where the percentage of total late payments remained relatively unchanged. Not only has the apparent plateau continued, the duration of lateness grew again. Payments averaged 3 days late across the portfolio (unchanged from H1 2024), but the percentage of payments made more than 15 days late rose to 15% and made a new record. Additionally, payments more than 6 days late comprised 25% of all payments, which is the worst performance on record.

- Underpayments fall but remain elevated – underpayments represented 14% of all payments, a 1% decrease compared to H1 2024. Although underpayments bounced sharply off the recent all-time high, they still remain near their highs. Furthermore, these elevated levels are driven by more frequent and smaller offsets rather than larger ones.

- Manual demand (Direct & Agency) worsened while Programmatic demand was flat – 59% of all manual payments were late and 30% were more than 15 days late (rising 4% and 6% from H1 2024, respectively). While 42% of all Programmatic payments were late (unchanged from H1 2024).

- Payor performance improved – Good paying debtors (those who paid on-time more often than late) rose significantly, representing 58% of all debtors (up 10% from H1). Debtors who always pay on-time fell to 21%, a slight 4% decrease from H1. Offsetting this was a significant increase to the number of debtors who paid late less than half of the time, which rose to 37% in H2.

Our Takeaway

The media and advertising industry continues to navigate a complex credit landscape, with economic uncertainty continuing to plague businesses. As recession risks mount, all eyes remain on the Federal Reserve. With economic growth slowing and inflationary pressures rising, the Fed faces a tough balancing act—one that could lead to a pause in rate cuts to uphold its policy mandate.

Why does this matter?

The Fed’s stance directly impacts liquidity and credit conditions across the media and advertising sector. A deviation from its current path would signal growing concerns about the economic outlook, potentially prompting a more cautious, hawkish approach. Regardless of what lies ahead, OAREX remains committed to empowering businesses with flexible liquidity solutions and helping them mitigate credit risks.

In a rapidly evolving financial landscape, staying proactive and informed is crucial. As conditions shift, ensuring stability and access to working capital will be key to long-term success.

Want to learn more about how OAREX can help you de-risk your cash flow and scale? Schedule a call to speak with our team.