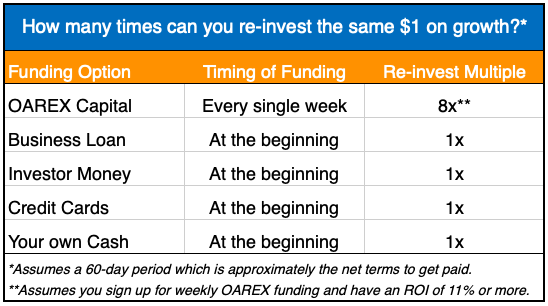

There are many ways to fund your business. You can use your own cash or run up a tab on your credit card. Other options include VC money or going to a bank. The biggest difference between our funding and those other options is spending power. With us, you can spend 8x more, which means bigger, faster growth. Here’s how.

Weekly Payments Allow 8x the Re-investment

With OAREX, you can sign-up to get funded monthly, weekly or whenever you want. With weekly payments, we’ll buy your most recent 7-days worth of invoices. Every week. This allows you to get the cash you need right away, so you can re-invest in growth. Here is how it compares to other funding options.

Let’s assume you wait 60 days to get paid, on average. We know this is pretty consistent with most demand stacks. This means that you can invest each dollar once every 60 days – if you secure those dollars from a loan, credit cards, VCs or your own pocket.

However with OAREX, since we fund you weekly, you can invest the same dollar 8 times in a 60 day period. Spend the money days 1-7, you’ll get that money back day 8. Spend that money days 8-14, you’ll get it back day 15. So on and so forth. By day 60, you will have spent 8x the amount of money you otherwise would have. In other words, we will give you 8x spending power. To drive the point home even further – you need 8x the amount of money to have the same effect as OAREX.

OAREX Gives You Leverage Without Risk

When you borrow money to grow, you leverage up your business. Leverage means amplify the gains and the losses. If a demand partner doesn’t pay you, it could be disastrous. Imagine you run up at tab on your credit card (to grow faster), but a demand partner doesn’t pay you. Now you have 2x the loss – you owe the credit card company and a demand partner owes you. Not a good situation to be in.

With OAREX’s weekly funding option, you will get the benefit of leverage without the potential risk. That’s because we take the credit and financial risk from you. So you can ramp up 8x faster and not have to worry about going bust if a demand partner doesn’t pay. Imagine all the growth potential without all the risk. That’s what you get with OAREX. You stand to capture all the upside without the downside. Other options just don’t compare.

Economics 101: Opportunity Cost > OAREX Fees

Given that you can spend 8x more with OAREX, the cost of not taking our money far outweighs the cost of taking our money. Don’t wanna pay us a fee? That’s fine, but imagine all the money you’re leaving on the table.

Make the most of Q4, sign-up today.