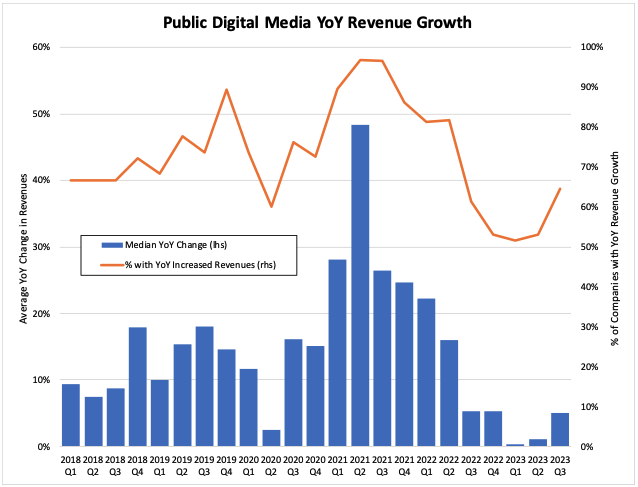

Did Q3 2023 digital media revenue growth rebound? Not quite. Since beginning its downward trend in Q3 2022, digital media revenue growth has continued to worsen with each new quarter. After setting a record new low in Q1 2023, with growth worse than Covid-19 lockdown-era, the revenue growth decline plateaued. Then, in Q3, revenue growth began showing signs of life. While far below historical performance, year-over-year (YoY) median public digital media revenue growth increased by 5%. Does Q3’s performance mark a change in trend? Perhaps, but it is too soon to say. Given how it compares to past performance, this could be more of a “dead cat bounce”. Recent 2024 outlooks from major ad groups like Dentsu and GroupM suggest growth expectations will be slow or worse than previously projected.

Tired of mainstream media focusing only on “Big AdTech”, our team began examining public revenue data for the broader digital media industry. We review the revenues of more than 30 public digital media companies and compare their performance next to “Big AdTech”. In our last report, digital media revenue growth reached its lowest pace in the past 5 years. Today we are releasing the 2023 Q3 Digital Media Revenue Report to share our findings.

Companies Analyzed

We evaluated data from publicly traded companies, in the USA, with financial reports denominated in USD. Those companies must also earn a majority of their revenues from digital media operations and have been underwritten by OAREX’s credit team. Furthermore, we excluded some “Big AdTech” companies to ensure the data was not outweighed by industry giants (i.e. Google, Meta, and Snap).

Key Findings In The Report

- With a median growth rate of 5%, Q3 2023 digital media revenue growth is showing signs of life and may even be rebounding. While this is a positive development, given the recent downward trend, it is important to note that 5% growth is far below historical performance.

- 65% of companies saw positive revenue growth, an improvement over the 61% of companies in Q3 2022 and another step in the right direction.

- Google’s revenue growth remained flat versus Q2 2023, while Snap saw revenue growth increase by 5% and Meta saw a significant increase of 23%.

- Correlation between size and performance continues in Q3. All companies in the index with a market capitalization over $5 billion saw revenue growth of 20% or more.

- Dispersion is up but it’s still holding below historical performance and is keeping results muted. Q3 2023 had 22% dispersion, which is up from consecutive quarters of 19% but far below the range seen in years prior (30-40%).

- Biggest Winners: Unity, DoubleVerify, Hubspot and The Trade Desk experienced YoY growth rates of over 25%.

- Biggest Losers: System1 and Fluent saw revenue growth decrease by over 25%.

Our Takeaway

Finally, some good news on the revenue growth front. We love growth but discretionary spending is down and 2024 ad forecasts are being downgraded, so we remain optimistically cautious for now. The Fed is anticipating rate cuts in 2024, which may help alleviate some of the economic pressure, but they are holding steady at the moment. We remain hopeful that the worst is behind us and “it’s only up from here”, but we just emerged from the worst quarterly growth on record and it is probably too soon to start celebrating. If the downward trend resumes in Q4 then we may be looking at a profit recession soon. As always, we recommend the following to companies looking to steady their footing. First, shore up access to capital. Liquidity allows companies to focus more on exploiting ROAS and less on managing cash flow, so they can make the most of every opportunity. Second, make credit management a focus. Stay vigilant so you don’t get burned when the next demand partner goes up in smoke. If credit analysis and financial engineering are not your foray, OAREX is happy to help on both fronts.

Want to see more? Download a copy of our free report here or schedule a call to speak with our team.