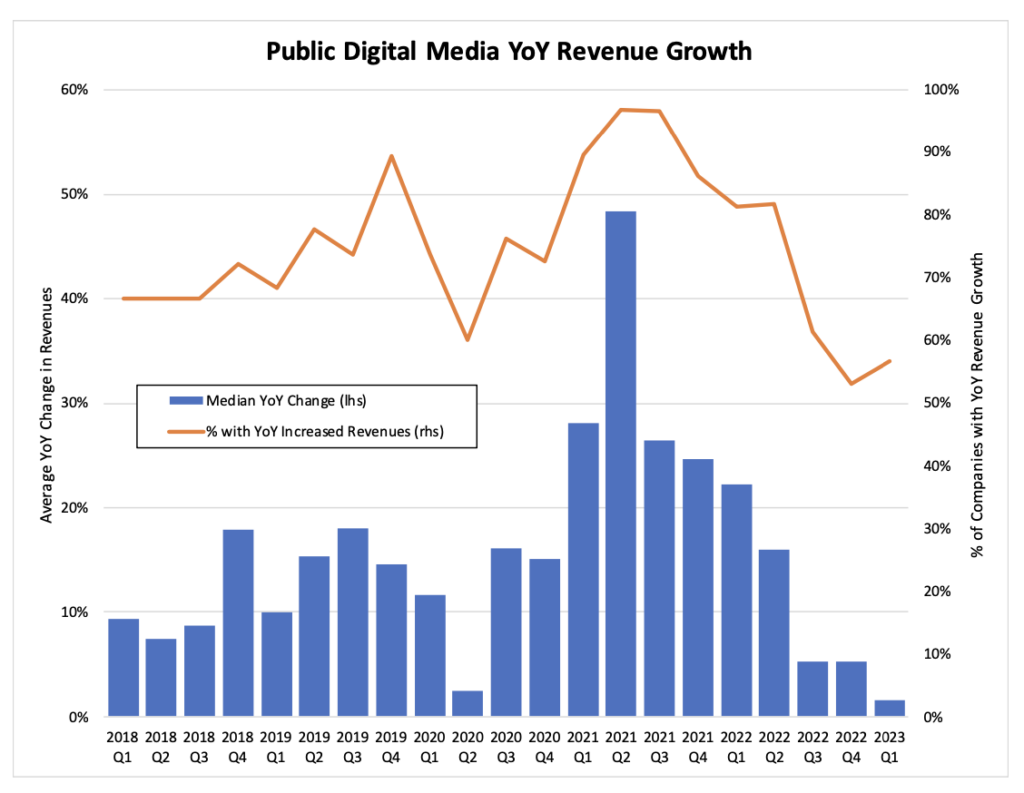

In Q3 2022, digital media revenue growth slowed to its lowest levels since the black swan known as “Covid-19” sent economies into lockdown and global markets reeling. Then, in Q4, revenue growth slowed even further. Again marking a new worst for ex-Covid growth rates. Unfortunately, the trend in slowing growth continued but this time it slowed to new lows. Q2 2020 brought a black swan but Q1 2023 digital media revenue growth was worse. With performance dipping below lockdown-era levels, Q1 has officially set the bar for worst quarterly growth on record. On top of that, another AdTech “OG” recently bit the dust. Add MediaMath’s bankruptcy to the ever growing list of defaults in AdTech.

Tired of mainstream media focusing only on “Big AdTech”, our team began examining public revenue data for the broader digital media industry. We review the revenues of more than 30 public digital media companies and compare their performance next to “Big AdTech”. In our last report, Q4 2022 digital media revenues had the worst showing (outside of covid influenced Q2 2020) in the past 5 years, further confirming the AdTech slowdown. Today we are releasing the 2023 Q1 Digital Media Revenue Report to share our findings.

Companies Analyzed

We evaluated data from publicly traded companies, in the USA, with financial reports denominated in USD. Those companies must also earn a majority of their revenues from digital media operations and have been underwritten by OAREX’s credit team. Furthermore, we excluded some “Big AdTech” companies to ensure the data was not outweighed by industry giants (i.e. Google, Meta, and Snap).

Key Findings In The Report

- With a median growth rate of 2%, Q1 2023 digital media revenue growth saw it’s slowest rate in 5 years. Performance even dipped below Covid influenced global lockdown levels seen during Q2 2020.

- 57% of companies saw positive revenue growth, marking the second worst performance on record. This is a slight improvement from the low of 53% which was set in Q4 2022.

- Google and Snap saw revenue growth decline by 8% and 7%, respectively, while Meta stayed in line with the broader AdTech industry, experiencing a 2% rise.

- While some companies saw large increases, dispersion is still holding near record lows. Q1 2023 marked the third consecutive quarter of 19% dispersion and remains well below the 31% median. Prior to this 9-month stretch, performance was consistently volatile over the past five years and dispersion never held constant in back-to-back periods.

- Biggest Winners: Unity, AdTheorent, Hubspot, and DoubleVerify experienced YoY growth rates of over 25%.

- Biggest Losers: MediaAlpha saw a 22% YoY drop and Digital Turbine was down by 24%.

Our Takeaway

Another new quarterly revenue report and another new low in revenue growth rates. We remain hopeful that economic conditions will start to improve, but nothing in the data suggests the tides will turn anytime soon. Recent macro economic data is mixed, both economic growth and inflation have slowed but the Fed is holding strong to their path. Perhaps they will pause rate hikes soon but we prefer to avoid such speculations. Instead, we will prepare for more credit tightening and increased risk.

One thing is for sure, if performance doesn’t improve soon then the next stop is a profit recession. Q1 median revenue growth was at 2%, there isn’t much room left before we enter profit loss territory. Given the current landscape, there are 2 aspects we recommend publishers review to put themselves on solid ground. First, shore up access to capital. Liquidity allows companies to focus more on exploiting ROAS and less on managing cash flow, so they can make the most of every opportunity. Secondly, take a renewed interest in credit management and stay vigilant so you don’t get burned when the next demand partner goes up in smoke. Lastly, if credit analysis and financial engineering are not your foray, OAREX is happy to help on both fronts.

Want to see more? Download a copy of our free report here or schedule a call to speak with our team.