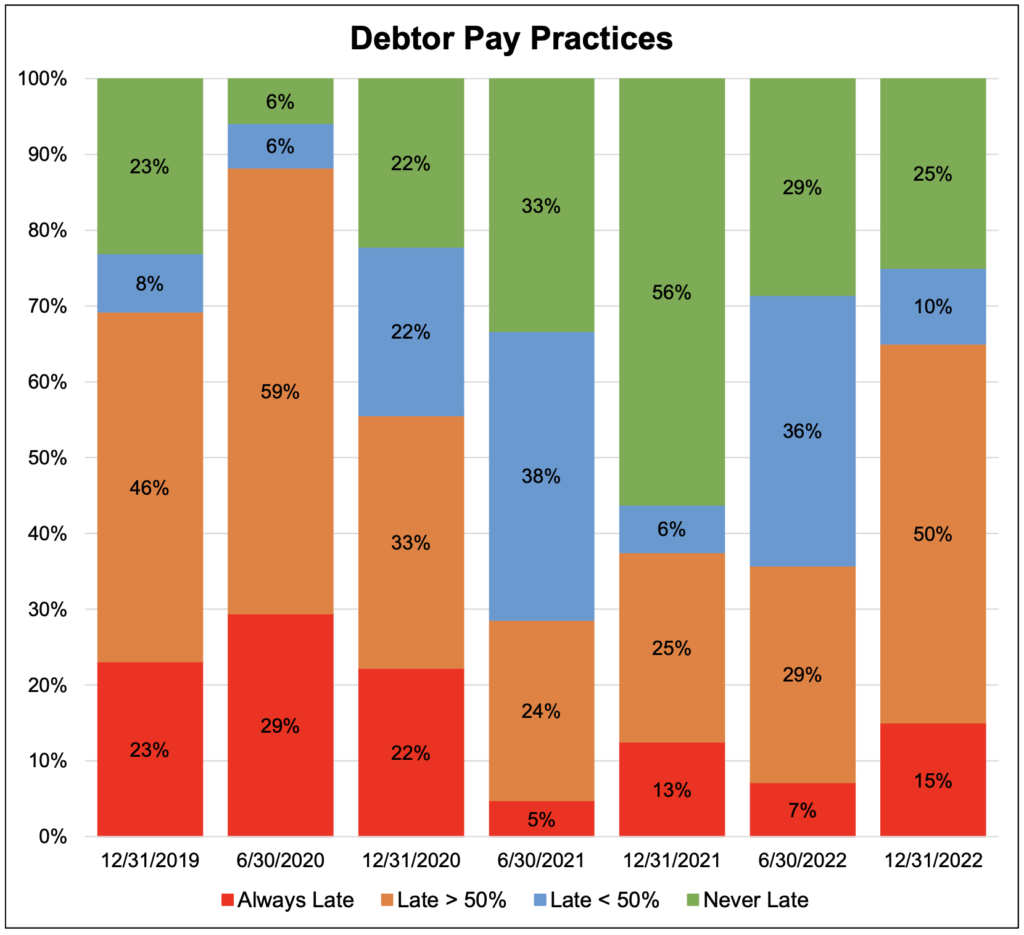

Today, we are releasing our H2 2022 Payment Study, which covers payment trends in the digital media and advertising ecosystem. Unfortunately, like everything else during H2 in AdTech, the data on debtor pay performance was ugly. One key area that caught our attention was the increased frequency of late payments among individual demand partners. Across our total portfolio, 65% of demand partners paid late more than half the time. That is quite a jump from being 36% in H1. Even worse though was the percentage of demand partners who paid late 100% of the time, which more than doubled to 15% in total (up from 7% in H1). Overall, each metric that we track worsened when compared to H1 2022. Below we outline the key highlights from our report and provide our thoughts on what this could mean for the industry.

At this point, you may be thinking “late payments are common, so what! I eventually get paid”. However, with the Big Village / EMX Digital bankruptcy fresh on our minds, we will explain why you should care about the frequency of late payments and what you can do to better mitigate the growing credit risk within AdTech.

Key Findings In The Report

- Trend towards later payments continues – 43% of all payments were late, up from 41% in H1. Additionally, the average payment arrived 3 days later than in H1 (3 days early in H1 vs. on-time in H2).

- Frequency of demand partners that paid late spiked – 15% always paid late (7% in H1) and 65% pay late more than half the time (36% in H1).

- Underpayments increased – 14% of all payments were offset during H2, up from 12% in H1.

Best Practices When Mitigating Risk

Mitigating credit risk is a “one-two” process. Step one, partner with OAREX. Step two…whoops, it was actually a one step process.

In all seriousness, credit risk is no laughing matter. It is very real and, unfortunately, we often speak with prospects who shrug it off in lieu of better performing CPMs / CPAs. That is fine, until it isn’t. We all wish there was a siren that warned of the imminent peril that awaits us, but there is none. Instead, there are various signals which can be used collectively to help identify high risk situations. Below are 5 red flags to consider when evaluating demand partners:

- The Terms Aren’t Clear – review your contract! Make sure it is clear and there are no loopholes baked in.

- The “Melt Up” – this is a big one. When things start going south for a demand partner, they typically offer abnormally aggressive rates to win new business. It’s a last ditch effort that always leads to collapse.

- Lack of Transparency and Suspicious Offsets – if a demand partner is having trouble explaining details about why they offset an invoice, you should be very concerned. If they suddenly become non-communicative or start giving you the run around on explaining things like why they haven’t paid you yet, run.

- Late Payments – the canary in the coal mind. Always have your thumb on the pulse with how your demand partners typically pay. Tools like the Reddit AdOps community can help you catch issues at the start. As mentioned earlier, late payments are not always a sign of trouble. If they are abnormal though, beware.

- Sequential Liability – hard to avoid this one since it is in most agreements these days. Still, make sure to know if your agreement has one and consider their demand stack. If they are highly diversified then that is better for you.

Why It Matters

For some reason, late payments are commonplace in AdTech and are often expected. Yet, even with the notion of late payments being a “cost of doing business”, it is vitally important to monitor your demand partners’ pay performance and seek out irregular activity. Last year was tumultuous, but we basically experienced unchecked growth for the two years prior. The landscape before us now is different and, with credit tightening, fraud and bankruptcy risk is rising rapidly. A prime example of that is the Big Village / EMX Digital bankruptcy announced last week. Only time will tell how far reaching the implications from this shake out will be. Considering everything though, we will leave you with two thoughts.

- Credit events can be contagious and we anticipate more shakeouts are likely to happen at some point. Our team will be available to help companies navigate the choppy waters that lie ahead.

- During H2, EMX paid late 100% of the time and by an average of 19.5 days (for reference, the average programmatic payment arrived on-time). Additionally, the Reddit AdOps community was abuzz about abnormal payment delays and lack of communication/transparency from EMX’s team. Collectively, the signals outlined above started painting a picture of what was to come. It’s not a full proof method but hopefully it can help you avoid catastrophic losses in the future.

Want to learn more about how OAREX can help you de-risk your cash flow and scale? Schedule a call to speak with our team.