The media and advertising landscape is ever-evolving and payment performance remains a critical indicator of industry health. In our previous report for H2 2023, debtor payment performance began showing mixed signals but continued to worsen overall. The percentage of late payments across our portfolio fell for the first time since H2 2021 but they only dropped by 2% and remained near their all-time high. Meanwhile, underpayments accelerated at record pace. Jumping to 20% of all payments and marking the 2nd consecutive period of a new all time high. We attributed this rise in offsets to the current credit environment and the fallout from some notable H1 2023 bankruptcies (e.g. EMX and MediaMath). Now, with underpayments bouncing off of their previous high and falling back to 15% in H1 2024, it appears our sentiment on sequential liability may have been correct. Nevertheless, payment trends remain mixed but the general notion may be more positive this time. Read more or download our report to find out why overall performance improved in H1 2024, despite later payments.

Key Findings In The Report

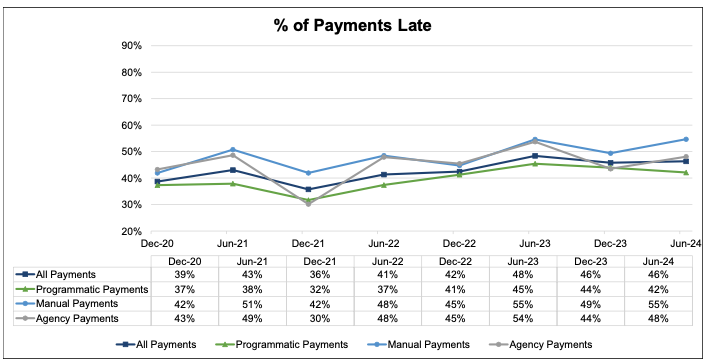

- Late payments remain elevated and arrived later – 46% of all payments were late in H1 2024, marking the 3rd consecutive report where the percentage of total late payments remained relatively unchanged. While late payments may have plateaued, the duration of lateness increased. Payments averaged 3 days late across the portfolio (up from 2 days late in H2 2023). While the percentage of payments made more than 15 days late increased to 11% (up 4%) and the average days late (if late) rose to 12 days. Additionally, payments more than 6 days late comprised 23% of all payments, which is the worst performance observed over the past 4 years.

- Underpayments fall but remain elevated – underpayments represented 15% of all payments, a 5% decrease compared to H2 2023. Although underpayments bounced sharply off the recent all-time high, they still remain elevated and only fell to their previous high. Furthermore, these elevated levels are driven by more frequent and smaller offsets rather than larger ones.

- Manual demand (Direct & Agency) worsens while Programmatic demand improves – 55% of all manual payments were late and 24% were more than 15 days late (rising 6% and 5% from H2 2023, respectively). However, 42% of all Programmatic payments were late (a 2% decrease from H2 2023).

- Payor performance still flat – 24% of debtors always paid on-time, rising from an all time low of 11% in H2 2023. In total, the percentage of good paying debtors (those who pay late less than half the time or are never late) was about 51% of all debtors. Representing a slight 2% decrease from H2 2023.

Our Takeaway

As we navigate the remainder of 2024, the media and advertising industry continues facing a complex credit environment. Recent economic data suggests the possibility of 2024 rate cuts which has brought hope back to US markets. All eyes will be on the Federal Reserve this week to see if they pivot towards a more dovish stance. Till then, our position remains status quo.

While the improvements in H1 2024 are promising, it’s crucial to remember that payment performance metrics remain elevated. More time and data are needed to determine whether these trends are simply a temporary reprieve or something more permanent. Regardless of what the future holds, OAREX remains committed to supporting the industry with flexible liquidity solutions and helping businesses mitigate their credit risks. Staying proactive and informed is key to thriving in this evolving landscape.

Want to learn more about how OAREX can help you de-risk your cash flow and scale? Schedule a call to speak with our team.