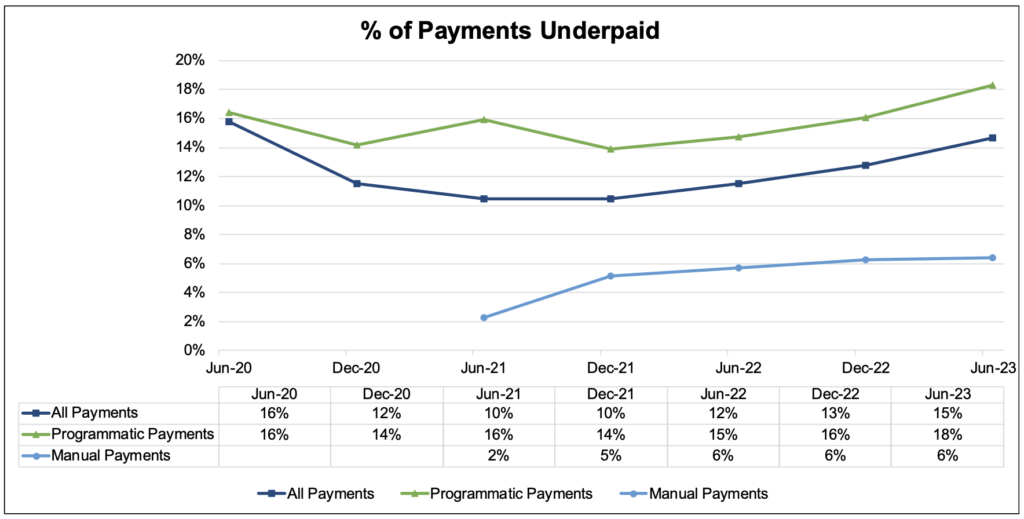

Today we are releasing our bi-annual payment study, which outlines why H1 2023 experienced the worst 6 months for payments since COVID. In our report, we cover payment trends in the digital media and advertising ecosystem. Unfortunately, like revenues and stock performance (see our most recent Digital Media Revenue Report), debtor pay performance continues to deteriorate. The first half of 2023 marked the worst pay performance seen since COVID pandemic lockdowns. With 46% of all payments arriving late, we are close to the 52% high witnessed in H1 2020. Furthermore, at 15% of all payments processed, underpayments also increased dramatically and are near their COVID highs of 16%.

Making matters worse is that MediaMath, one of the early DSPs that helped pioneer the AdTech ecosystem, announced their bankruptcy in June. Putting an exclamation point at the end of an already disheartening first half and ensuring H2 2023 gets off to a rocky start as supply partners are forced to address the resulting sequential liability and several months worth of offset. Read more or download our report to find out why H1 2023 was the worst 6 months for payments since COVID.

Key Findings In The Report

- Where have all the “good guys” gone – Only 2% of all payors paid on time, down from 10% last half. There are a number of steady demand partners who never paid late historically but, all of the sudden, were late – not significantly late, but still abnormal.

- There were less “bad guys” this time – After seeing a big spike in our last report, the number of always late payors dropped off during the first half of this year. In H2 2022, 29% of demand partners always paid late but only 17% in H1 2023.

- Majority of Agency payments are late and they’re arriving later – Agencies pay late, that is no surprise, but 55% of all agency payments were late in H1 (up from 44% in H2 2022). Perhaps worse is that they are also getting longer, with 36% of late agency payments arriving more than 15 days late (up 8%).

- Late payments and underpayments near COVID highs – The trend towards late payments and underpayments continues, both rising again and respectively comprising 46% and 15% of all payments.

What To Expect Next – MediaMath and Beyond

The AdTech industry often accepts late payments as a common occurrence, but it’s crucial to stay vigilant about monitoring demand partners’ payment performance for irregularities. While the Federal Reserve has made progress in addressing inflation, there’s more work ahead, indicating ongoing credit tightening and elevated risk. Although we are hopeful for a return to normalcy by Q4, it’s unlikely that payment performance will notably improve by our next report.

Starting in July, we began noticing offsets related to the MediaMath bankruptcy. MediaMath filed for bankruptcy in June, owing millions to major industry players like Google, Magnite, OpenX, PubMatic, and Xandr. Thanks to sequential liability, an inherent risk in AdTech, effects from MediaMath’s bankruptcy are now flowing through the supply chain and have begun impacting publisher’s earnings. We’ve seen offsets as high as 18% tied to MediaMath and expect these ripples to continue through the AdTech ecosystem.

This highlights the enduring nature of sequential liability and underscores the need for SSPs and supply partners to be attentive in credit monitoring, managing cash flow, and diversifying revenue streams. Publishers expect their SSPs to manage these risks and end up bearing the brunt of offsets when they don’t. For example, MediaMath’s struggles were evident long before their bankruptcy. In response to deteriorating credit indicators (e.g. delayed payments), OAREX suspended their approval in Q3 2020. How many publishers could have avoided significant loses had their demand partner done the same?

Want to learn more about how OAREX can help you de-risk your cash flow and scale? Schedule a call to speak with our team.