Recently, media outlets have painted a very grim outlook on global ad spend and the economic health of the advertising industry. Their narrative is hard to deny – layoffs sweeping across the industry and a looming recession. Still the IAB is projecting 2023 media ad spend to increase 5.9% YoY. How can ad spend continue slowing but still grow next year? These conflicting narratives can’t be right. So, we took to “the streets” for an answer. Our findings? The normative vs. empirical outlook on ad spend is surprising.

Normative VS. Empirical…What Is That?

In psychology there is a theory of normative and empirical reality. This conceptual view of reality acknowledges that there is a dissonance between our view of the world as it should be versus how it actually is. Although it is possible that these two views coincide with each other, more often than not they contradict one another.

Normative reality is built on value judgements. This is our concept of reality as we think it is, should be or want it to be. Empirical reality is measurable and built on facts. This is our true reality, the world we actually live in.

OAREX Ad Spend Survey

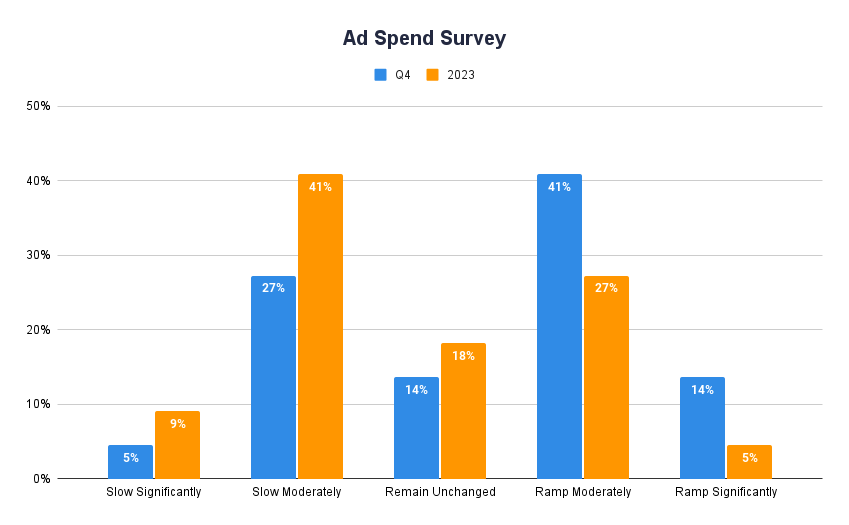

While the economic indicators of our empirical reality agree with the media outlook, our ad spend survey suggests a very different normative assessment. We expected to see responses staunchly in favor of slowing ad spend but, to our surprise, respondents are anticipating a different outcome.

According to our survey, 55% of respondents expect ad spend to continue ramping in Q4 and 32% believe ad spend will grow in 2023. Granted, the majority of participants believe ad spend will slow in 2023, only 9% are bracing for a significant slowdown – a fairly small percentage compared to what we are led to believe based on media reports.

While we agree that times have been better for the advertising industry, we also find these insights interesting and feel they may paint a more optimistic outlook. Only time will tell how a dovish Fed and a positive rate environment will continue impacting the global economy. In the meantime, OAREX will be here to help accelerate available ad spend and provide valuable credit insights throughout the entire digital media ecosystem. If you would like to learn more about our data and credit insights, or how OAREX can help your business, please reach out to our team.